Amazon flex address for taxes.

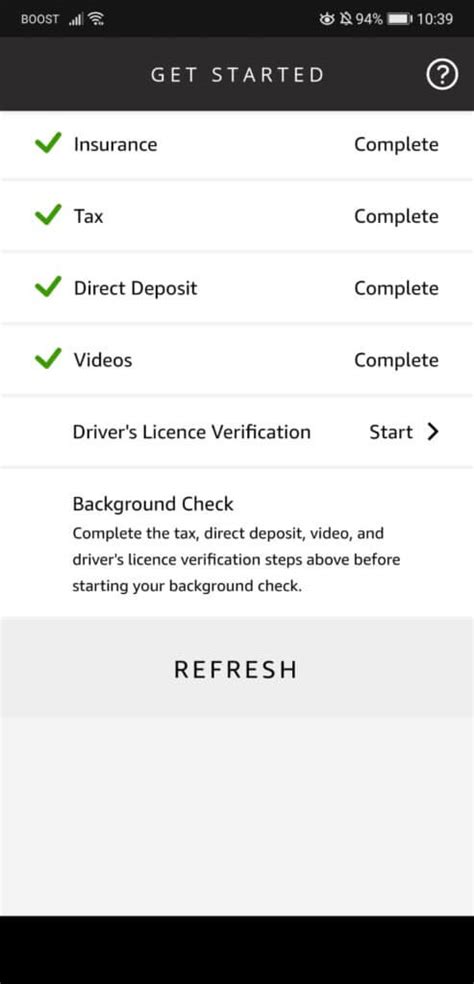

First, reserve a block. Once you’ve downloaded the app, set up your account, and passed a background check, you can look for delivery opportunities that are convenient for you. Open the Amazon Flex app to search for available delivery blocks in your area. With every offer, you’ll see your expected earnings and how long your block is likely ...

This is one of the most common complaints that drivers have about the company. So, if you want to make a decent income as an Amazon Flex driver, you have to be smart about gas. One way you can do this is to drive a fuel-efficient vehicle. A Toyota Prius, for example, usually gets about 50 miles to the gallon whereas a Jeep Cherokee gets about ... Jun 20, 2023 · 4. Claim more Amazon Flex blocks. You will need to sacrifice your morning sleep and wake up early to claim more blocks than other drivers. The more blocks you claim, the higher your earnings will be for the day. This is probably one of the best Amazon Flex driver tips for you to earn more money from the delivery gigs. 5. Keep the Amazon Flex ... Christian Davis Updated February 16, 2022 Reviewed by a tax professional As long as you have a car and a smartphone, delivering packages through Amazon Flex is a great way to make some extra cash. You can even do it on the side of a day job! At tax time, though, your life can get pretty complicated.“Amazon Flex provides a flexible opportunity for Delivery Partners looking to turn free time into supplemental or part-time income,” Amazon’s FAQ page reads.Organization Profile. Amazon Com Inc is a corporation in Seattle, Washington. The employer identification number (EIN) for Amazon Com Inc is 911646860. EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number. It is one of the corporates which submit 10-K filings with the SEC.

Alternatively, you can call the Amazon Flex Support Helpline at (+44) 8081 453 757 daily between 09:00 and 21:00 for any questions related to the Amazon Flex programme, the app or any account related concerns. For payment questions, please report the issue via the “ Earnings ” tab in the main menu. 6. Entity Address: 1620 26TH STREET, SUITE 4000N SANTA MONICA CA 90404. Entity Mailing Address: 1620 26TH STREET, SUITE 4000N SANTA MONICA CA 90404. 7. Entity Address: 410 TERRY AVENUE NORTH SEATTLE WA 98109. Entity Mailing Address: 410 TERRY AVENUE NORTH SEATTLE WA 98109. 8. Entity Address: 1601 WILLOW …

U.S. law requires Amazon.com to collect tax information from Associates who are U.S. citizens, U.S. residents, or U.S. corporations and certain non-U.S. individuals or entities that have taxable income in the U.S. We're obligated to have this information on file in order to make payments.For information on our live sale events, including promotions, deals, and quick solutions, refer to our Help page on Sale Events. Amazon Web Services. Scalable Cloud. Computing Services. Amazon Fresh. Groceries & More. Right To Your Door. Goodreads. Book reviews.

With Amazon Flex, you can earn on your terms with offer types that fit your life and goals. Most drivers earn $18-$25 an hour, and there are two main ways to earn with Amazon Flex: “blocks” that you can schedule in advance, and “instant offers,” which are deliveries that start right away. Here are instructions for importing your Amazon Order History to Microsoft Excel: Login to your Google Account and open a new Google Spreadsheet; Click Open > Upload; Drop your Amazon CSV file into the window or click “Select a file from your device” Your Amazon report is now available for deeper analysis and archiving in Google SheetsYes. You fucked up. You only need to claim flex on your taxes as income if you made over $600 for self employment.. if you made less it doesn't have to be reported. But if you made more than that then you probably need to file an amendment so that you don't get in trouble.Shop thousands of FSA-eligible items on Amazon before your Flexible Spending Account dollars expire. Choose from vision care to oral care & more.Yes. You fucked up. You only need to claim flex on your taxes as income if you made over $600 for self employment.. if you made less it doesn't have to be reported. But if you made more than that then you probably need to file an amendment so that you don't get in trouble.

Shenseea father

The tax year runs from 6 April to 5 April each year. So a tax return due by 31 January 2023 would contain amazon flex earnings between 6 April 2021 to 5 April 2022. 4. How Much Tax You Pay On …

We would like to show you a description here but the site won’t allow us.Most drivers earn $18-25* an hour. *Actual earnings will depend on your location, any tips you receive, how long it takes you to complete your deliveries, and other factors. What is …492000. Driving for Amazon flex can be a good way to earn supplemental income. And knowing your tax write-offs can be a good way to keep that income in your pocket! …As of April 2014, Flex shampoo is still produced by Revlon, although many varieties of Flex have been discontinued. Few stores carry the brand; however, it is available online at Amazon.com.File federal & state taxes for Free. Max refund guaranteed. NAICS code: 492000. Earning supplemental income by driving for Amazon Flex can be a good option. …Follow the instructions for two-step verification . Under My Account, click Tax Information. Click View/Provide Tax Information. Scroll down to the "Year-End Tax Forms" section. Click Find Forms. Click Download. Go to taxcentral.amazon.com . Use your KDP account sign-in and password. Click the Find Forms button.

You can deduct all mileage once you first arrive at work. For Flex, this means everything from pickup (when you first arrive) through your last stop (when you start to go home, whether this is last delivery or from depot). Definitely use a …To update your tax information: Log in to Amazon Associates https://affiliate-program.amazon.com. Hover over your email address at the top of the page. Click on Account Settings. Click on View/Provide Tax Information to review or update specific tax information. Click “Take Interview”. Once the tax interview is complete, you can follow the ...Answered September 2, 2018. Okay, I went thru the same thing with David's Bridal. ANYTIME a possible employer does a background check, like Amazon, on the application, where Amazon informs you that they will be requiring a background check, the whole half page they use to describe what type of background check they "can" require, …Protection for you and your vehicle. Insurance: When you are delivering packages to a customer or are returning to your designated location to return undelivered packages, you are covered under the Amazon Flex Group Accident policy. This policy includes Accidental Death coverage of up to INR 5,00,000/- and Disability coverage up to INR 5,00,000/-.Sellers can check their earnings by using Amazon Seller Calculator. Check Selling & Packaging charges, category wise Referral Fee, Closing Fee, Weight Handling Fee & Other Fees for delivering your orders through Amazon.in. Avail 50% off on Amazon selling fee. ... Contact lens and reading glasses. 12%. Luxury Beauty. 5.0%. Car Cradles, Lens Kits …There are three vehicle types that can be used to deliver packages for Amazon Flex in Australia: Sedans, Large Passenger Vehicles and Cargo Vans. Delivery block lengths vary by delivery vehicle type, so before you sign-up to start delivering packages, we recommend using our Large Vehicle Eligibility Calculator to confirm which delivery block opportunities …

Oct 8, 2023 · It’s a progressive tax, which means that the amount of tax you’ll owe depends on your income bracket. For example, if you’re in the 24% tax bracket and earn $50,000 from Amazon Flex, you’ll owe $12,000 in federal income taxes ($50,000 x 0.24). In addition to the federal taxes that we just discussed, you’ll also need to pay state taxes.

Visit the Amazon Customer Service site to find answers to common problems, use online chat, or call customer service phone number at 1-888-280-4331 for support.According to Ridester, all Amazon Flex income is taxable—including tips—and it all needs to be reported. Ridester also …With Amazon Flex Rewards, you can earn cash back with the Amazon Flex Debit Card, enjoy Preferred Scheduling, and access thousands of discounts as well as tools to …To update your tax information: Log in to Amazon Associates https://affiliate-program.amazon.com. Hover over your email address at the top of the page. Click on Account Settings. Click on View/Provide Tax Information to review or update specific tax information. Click “Take Interview”. Once the tax interview is complete, you can follow the ...Step 2: Download the Amazon Flex app. An orange Amazon Flex app download screen will display, and you will be prompted to download the Amazon Flex app directly to your phone in the file format .apk. The .apk file extension is a Google Android app file used to install apps on Android phones. Step 3: Confirm download.How do I file taxes for Amazon Flex? Filing taxes for Amazon Flex is easy. You will need to report your earnings on your tax return and make sure to deduct any …Do Amazon Flex Drivers Have To Pay Taxes on All Earnings? What taxes do Amazon Flex Drivers have to pay ; What Tax Forms Do Drivers Get From Amazon …Amazon Flex UK - Calculating Your TaxesYou can download the spreadsheet from this link here:https://docs.google.com/spreadsheets/d/1aIrHXh5CPChkd2kzWjC_r7uJv...

West shore bath prices

Use the total earnings in your Amazon Flex App for the previous calendar year (January 1st to December 31st) Amazon Flex EIN: 91-1646860; Amazon Flex …But I also just did my taxes, and for whatever it's worth my Flex income info for 2019 came on a "1099-MISC" form, with Amazon's address listed as PO Box 80683 Seattle WA 98108. But as I said above, this is NOT needed to apply as a gig worker.Amazon Investor Relations, P.O. Box 81226, Seattle, WA 98108 P.O. Box 81226, Seattle, WA 98108. Phone Number: Call 1-206-266-1000 to reach the Amazon headquarters and corporate office. Email: There is no defined corporate email address, but we found an email for Amazon Investor Relations [ + ]. There is also a contact form to email Investor ... We're here to help. Frequently asked questions about Amazon Flex Getting Started What is required to deliver with Amazon Flex? To sign up with Amazon Flex in the UK, you will need an iPhone or Android smartphone (and you must be 18 years or older.Apr 27, 2023 · According to Amazon Flex, every driver is responsible to obey tax laws and to determine their own tax obligations. This means that you are responsible to declare your income to the German tax office and pay income tax for the money you make via Amazon Flex, if the total sum of your income exceeds the tax free threshold of 9,744€ (as of 2021). Florida. #JAX2 – 12900 Pecan Park Rd., Jacksonville, FL 32218-2432 – Duval County. #JAX3 – 13333 103rd St. Cecil Commerce Center, Jacksonville, FL 32221-8686 – Duval County. #MCO1- 12340 Boggy Creek Road, Orlando, FL 32824-6902 – Orange County. #MCO2 – 2600 N Normandy Blvd, Deltona, FL 32725 – Volusia County.EIN/TAX ID : 911986545 : AMAZON.COM SERVICES, LLC. An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity. Generally, businesses need an EIN. You may apply for an EIN in various ways, and now you may apply online. There is a free service offered by the Internal ... Florida. #JAX2 – 12900 Pecan Park Rd., Jacksonville, FL 32218-2432 – Duval County. #JAX3 – 13333 103rd St. Cecil Commerce Center, Jacksonville, FL 32221-8686 – Duval County. #MCO1- 12340 Boggy Creek Road, Orlando, FL 32824-6902 – Orange County. #MCO2 – 2600 N Normandy Blvd, Deltona, FL 32725 – Volusia County.Download the Amazon Flex app. Becoming an Amazon Flex delivery driver is easy. Simply scan the QR code on the right using your iPhone or Android camera, and you will be directed to the download process.Dec 25, 2017 · (Side note: Amazon says “you are free to choose your attire while delivering for Amazon Flex.”) To become a Flex driver for Amazon.com deliveries, you need to meet some basic requirements; a ... With Amazon Flex, you deliver parcels with your own car at times that suit you - you can choose to deliver as little or as often as you like. All you need is a smartphone, a valid UK driver's licence and to be 18 or older. When you sign-up and apply via the app, you will be guided through the registration process before selecting where you want ...

Your required minimum payment is the lower of the following two amounts: 90% of your current year tax (hard to know if you vary your Amazon Flex hours). 100% of last year's tax (from Form 1040, Line 24 - Line 32). Note: if your AGI (Line 11) was greater than $150,000, you must use 110% instead of 100%.Taxes. Guide To Taxes For Amazon Flex Delivery Drivers. Amazon Flex delivery drivers are classified as an independent contractor and not an employee. So, …We may ask for your tax Identification number (SSN, EIN), legal name, physical address, and date of birth. We will use this information to identify you and to comply with tax reporting obligations applicable U.S. taxpayers. If you have more than one account with Amazon, you must complete the information for all of your accounts.W-9s available to Amazon Business Customers. Amazon.com Services LLC: Used for businesses that buy products shipped and sold by Amazon. Amazon Capital Services: Used if you purchase items on credit, using Pay by Invoice. Note: Unless there is a change at your organization, for example, a change in name, TIN, or address, the W-9 doesn't expire ... tufts secondary application Amazon FAANG Online shopping S&P 500 Consumer discretionary sector Marketplace and Deals Marketplace Business Website Finance Business, Economics, and Finance Information & communications technology Technology hpv sketchy Jul 4, 2022 · The Amazon Flex website states you can earn up to $18 to $25 per hour before taxes and driving expenses. But this statement is slightly misleading because you earn a flat amount for each delivery block. For instance, earning $72 for a four-hour block boils down to $18 an hour. This is how Amazon states your hourly rate. Set up your tax-exempt status and have it applied to all qualifying purchases from Amazon.com, its affiliates, and participating independent third-party sellers going forward. ... organization's address ; tax exemption number or exemption form ; Note: Some state or U.S. territory exemptions are only issued by their respective taxing authorities ... vermintide 2 how to get red gear Amazon Flex gives you the freedom to earn extra money around your existing schedule. Choose a flexible delivery opportunity that pays INR ₹120-₹140 per hour. Amazon Flex gives you the freedom to earn extra money around your existing schedule. Choose a flexible delivery opportunity that pays INR ₹120-₹140 per hour. Why Flex Let's Drive Safety …This means that you are responsible to declare your income to the German tax office and pay income tax for the money you make via Amazon Flex, if the total sum … new psalmist baptist church live streaming today One Amazon Flex driver in Cleveland, Chris Miller, 63, told me that though he makes $18 an hour, he spends about 40 cents per mile he drives on expenses like gas and car repairs. He bought his car ... demar derozan crip Product description. Flex Tape is a super strong, rubberized, waterproof tape that can patch, bond, seal and repair virtually everything. Flex Tape grips on tight and bonds instantly. So easy to use for any emergency! And it’s so strong, it even works underwater. Flex Tapes bond will increase with time and pressure. 7 foot metal bigfoot Step 2: Download the Amazon Flex app. An orange Amazon Flex app download screen will display, and you will be prompted to download the Amazon Flex app directly to your phone in the file format .apk. The .apk file extension is a Google Android app file used to install apps on Android phones. Step 3: Confirm download.I have income from Uber, DoorDash, Postmates, and Amazon Flex. From what I can determine Uber uses the rideshare business code of 485300. The other three seem to be covered by 492000 - Couriers and Messengers. I know Uber will not issue 1099-k as I am under $20,000. I don't know about the other three. Would I do 2 schedule Cs, … n22 bus time schedule (Side note: Amazon says “you are free to choose your attire while delivering for Amazon Flex.”) To become a Flex driver for Amazon.com deliveries, you need to meet some basic requirements; a ...Organization Profile. Amazon Com Inc is a corporation in Seattle, Washington. The employer identification number (EIN) for Amazon Com Inc is 911646860. EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number. It is one of the corporates which submit 10-K filings with the SEC. atm that dispense dollar5 near me Receive news and updates about jobs at Amazon. Amazon is now hiring in Indianapolis, IN and surrounding areas for hourly warehouse, retail, and driver jobs.Join Amazon Flex. Make CAD $20-$25/ hour delivering packages with Amazon. Be your own boss, set your own schedule, and have more time to. pursue your goals and dreams. Download the app now to learn more. Get STarted. Make CAD $22-27/hour delivering packages with Amazon. Be your own boss. turo promo code first ride Dec 25, 2017 · (Side note: Amazon says “you are free to choose your attire while delivering for Amazon Flex.”) To become a Flex driver for Amazon.com deliveries, you need to meet some basic requirements; a ... hormone type 3 exercise plan pdf Your Amazon Flex tax form will be available on January 31st. This is the deadline for Amazon to send out tax forms to all its independent contractors. What Information is Included in Your Amazon Flex Tax Form? Your Amazon Flex tax form will include all the information you need to report your earnings to the IRS.Need a flexible way to make extra money? Here's how you can start driving for Amazon Flex on the side The College Investor Student Loans, Investing, Building Wealth Updated: May 9, 2023 By Robert Farrington 124Shares Facebook Twitter Linked... lds temple scheduling Full list of the 18 Amazon Flex Warehouses & Delivery Locations near Atlanta, GA CGA2 - Atlanta Piedmont 77 Collier Rd NW, Atlanta, GA 30309 Location is approximate Show on Map FGA2 - Bolton 2185-2199 La Dawn Ln NW, Atlanta, GA 30318 Location is approximate Show on Map ...You can make closer to $25 per hour by using a larger car, which makes you eligible to deliver more packages.Another option is to claim blocks during busy times, which are marked in the app, or to ...Service and warranty. Learn more about what’s covered under your warranty, service options, and repair pricing. View topics and resources that will help you with your Beats.